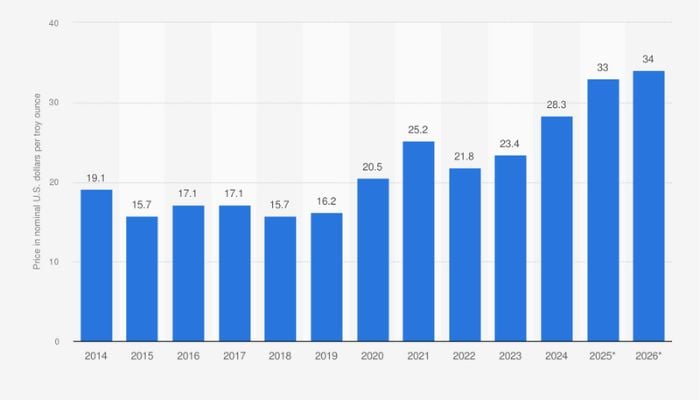

Silver rate soars to new all-time high, tops $69 per ounce

Retail traders bet on silver to lead metals again in 2026

December 22, 2025

Silver prices surged to a new all-time high near $69.44 per ounce on Monday, December 22.

This marks a historic year where the metal’s value increased more than double.

As this rally continues, analysts predict that silver will be the top-performing metal again in 2026.

As reported by Kitco News, top metals survey, a majority of Main Street investors predict silver’s dominance to continue. Gold was the second-most-popular pick while platinum and copper also had majority votes.

However, Wall Street analysts see a potential challenger. They have named platinum and palladium for their top commodity picks for 2026, estimating prices roughly 20% above market consensus.

They make the argument that silver's massive price spike may lead to a moderation of platinum group metals (PGMs) poised for gains due to strong demand and stockpiling trends.

The increasing surge in silver prices is attributed to a confluence of factors including rapidly growing expectations for the U.S. Federal Reserve rate cuts in 2036, persistent safe-haven demand, and robust investment inflows into silver-backed ETFs.

It is forecasted that silver will likely to trade between $43 and $62 in 2026.

With silver up approximately 138% year-to-date, the stage is set for a decisive start of the new year as investors watch to see if the precious metal can defy analysts’ predictions and deliver standout performance.