Why WBD rejects latest Paramount Skydance offer, reaffirms Netflix merger?

Warner Bros Discovery calls Paramount Skydance offer ‘inferior,’ citing debt risk and execution concerns

January 07, 2026

Warner Bros. Discovery (WBD) has officially rejected a hostile takeover bid from Paramount Skydance (PSKY), declaring the offer inferior to its existing merger agreement with Netflix and urging shareholders not to tender their shares.

The company stated that its board of directors unanimously concluded that Paramount’s revised offer is not a “Superior Proposal” under WBD’s merger agreement with Netflix.

On Tuesday, January 6, WBD released an official statement stating that Paramount’s proposal provides insufficient value and carries significant financial, operational, and execution risks.

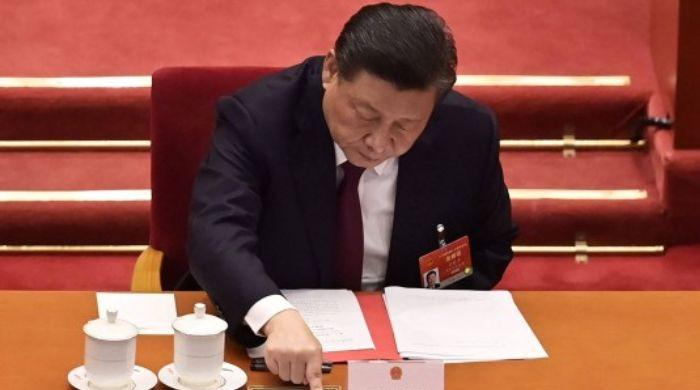

The rejection centered on WBD Chair Samuel A. Di Piazza Jr., whose stance that the bid relies on an “extraordinary amount of debt financing” raised serious doubts about Paramount’s ability to complete the transactions. It offered insufficient protection for shareholders if the deal collapsed.

Under the Netflix deal, WBD would receive $23.25 per share in cash plus Netflix stock valued at approximately $4.50 per share, alongside continued ownership in Discovery Global. This planned spinoff would house WBD’s global networks and sports assets.

The board affirmed that this structure is more stable and offers greater certainty with sustainable value creation in the future.

In comparison, according to the official statement, if WBD accepted the Paramount offer, it would only trigger around $4.7 billion in costs, including a $2.8 billion breakup fee owed to Netflix, debt-related penalties, and higher interest expenses.

These costs would sharply minimize the practical value of Paramount’s proposed $5.8 billion termination fee if its deal failed.

The board also highlighted the similarities between Paramount’s bid and a highly leveraged buyout that would saddle the combined company with an estimated $ 87 billion in debt, making it the largest leveraged buyout in history.

Adopting this structure will increase the risk of financial failure and delay regulatory approvals. Experts note that it will also cause operational constraints that could damage business during a prolonged 12-18-month closing period.