Is Netflix's Warner Bros deal masterstroke or costly mistake?

Netflix stock falls despite earnings beat as Warner Bros. gamble raises concerns

January 21, 2026

Netflix’s Q4 earnings unveiled strong results with $2.42 billion per share, up from $1.87 billion per share during the same period.

The streaming giant reported that revenue rose by over 18%. However, the stock price tumbled. It left investors with a familiar paradox: solid financial performance paired with a falling stock price.

While the company beat Wall Street expectations in Q4, its ambitious bid to acquire key assets of Warner Bros. Discovery has sparked concerns about whether the deal signals a transformative masterstroke or a risky, costly misstep.

In Q4, Netflix reported earnings per share of $0.56 on revenue of $12.05 billion, edging past analyst estimates.

| Revenues ($) | 45,183,036 |

| Operating Income ($) | 13,326,603 |

| Net Income ($) | 10,981,201 |

| Earnings per Share $ (Basic) | 2.58 |

| Earnings per Share $ (Diluted) | 2.53 |

However, the market reaction was quite negative. Shares slid sharply in early trading after the company released cautious first-quarter guidance and announced it would pause share buybacks to preserve cash for the Warner Bros. transaction.

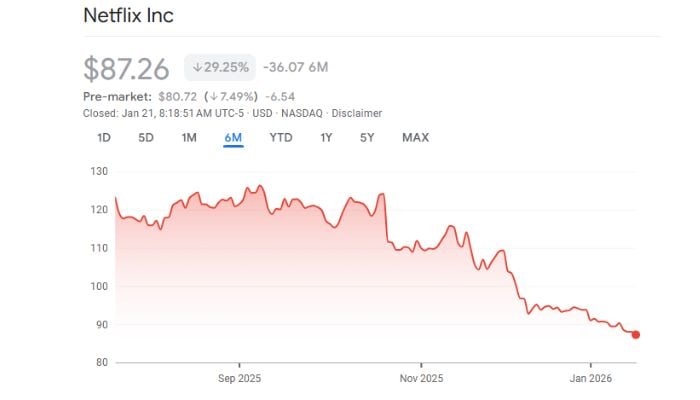

Since Netflix announced acquiring Warner Bros. Discovery in early December, its stock has fallen roughly 20%.

Apparently, getting control of Warner Bros. studio assets, HBO, and a vast century-old library could significantly strengthen Netflix’s competitive position.

Officials have argued that the deal will enable Netflix to expand production capacity, deepen intellectual property ownership, and generate $2 billion to $3 billion in annual cost synergies within three years.

But the risks remain. After Warner Bros transactions, a billion in debt would be added to Netflix’s balance sheet.

The firm has already identified around $275 million of additional expenses in 2026 related to the deal. On the other hand, the pace of subscriber additions is decelerating, with Netflix adding many fewer subscribers in 2025 than the previous year, raising concerns about whether the firm is over-leveraging itself at a time when growth is decelerating.

However, regulatory uncertainty further adds to the complexity, as the acquisition will bring together two of the biggest streaming services in the U.S., and the rival bid by Paramount Skydance further complicates the situation.

For now, however, investors are not convinced. Netflix’s Warner Bros. pact may reshape the future of streaming or prove to be a costly diversion at a pivotal point in the company’s development.