Trump family cryptocurrency firm World Liberty Financial's 49% stake sold to UAE firm

World Liberty Financial's 49% stake sold to the UAE investment firm is valued at around $500 million

February 02, 2026

A major stake in the Trump family's cryptocurrency company, World Liberty Financial (WLF), has reportedly been sold to investors linked to the United Arab Emirates (UAE), just days before Donald Trump's inauguration.

The sell-off of Trump's family crypto firm's nearly half-stake is reportedly valued at around $500 million. World Liberty Financial includes all three of Trump’s sons as co-founders and is closely associated with Steve Witkoff, a prominent Trump ally.

Sheikh Tahnoon bin Zayed al-Nahyan, the UAE’s national security adviser and a member of the royal family, was also involved in the deal, the Wall Street Journal revealed.

David Wachsman, a spokesperson for World Liberty Financial, encouraged the agreement, proclaiming it to be in the company's favour. “The idea that a privately held American company should be held to a unique standard is both ridiculous and un-American.”

Wachsman explained that Trump and Witkoff had no role in the deal and have not been involved with the company since Trump assumed office, with White House officials emphasising that Trump transferred control of his businesses to his children.

Anna Kelly, a White House spokeswoman, stated: “President Trump’s assets are in a trust managed by his children. There are no conflicts of interest.”

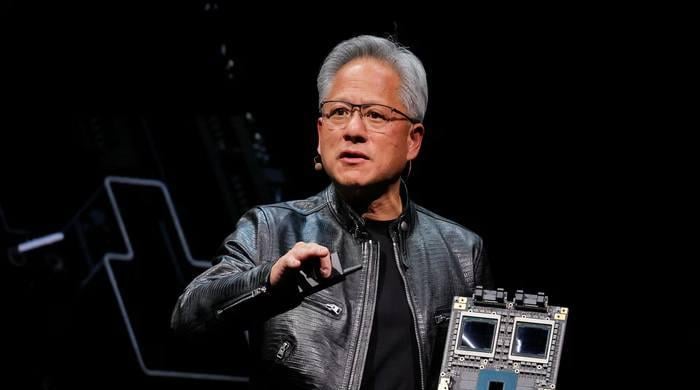

Besides chairing the UAE's sovereign wealth fund and a leading AI firm, G42, Sheikh Tahnoon runs a powerful investment empire.

The acquisition has also drawn criticism, spotlighting conflicts arising from Trump’s financial interests, particularly regarding the administration’s approval of advanced chip sales to the UAE.

Senator Elizabeth Warren has called for congressional testimony from key Trump officials about the deal, labelling it “corruption, plain and simple.”

The White House denied any link between the UAE investment and the administration’s decisions regarding chip sales to the UAE, asserting that Trump acts within ethical guidelines.